Chegg, a retailer of course materials and an online learning platform, has announced a significant restructuring plan aimed at sharpening its focus on students and enhancing its AI offerings.

“Today marks a pivotal step in refocusing Chegg towards subscriber and revenue growth,” stated Nathan Schultz, President and CEO of Chegg. “By becoming a more streamlined and efficient organization, we can innovate faster and better serve our core audience—the students. Our goal is to address unmet needs with a differentiated, holistic offering that is specifically designed for educational success.”

Key components of Chegg’s restructuring plan include:

- Refocused Efforts on Core Student Needs: Chegg will concentrate on students requiring comprehensive course support, aiming for positive educational outcomes through an all-encompassing support system.

- Reduction in Workforce: The company will reduce its global headcount by 23%, impacting 441 employees, to enhance operational efficiency and align expenses with current revenue trends.

- International Expansion: Increased resources will be allocated to Chegg’s international program, initially targeting six countries.

- Diversified Distribution Channels: Chegg will expand its reach by including direct distribution to educational institutions.

- New Branding and Marketing Strategy: Efforts will be made to engage students earlier in their educational journey, starting in high school.

- Simplification of Systems and Processes: Utilizing partner software for non-core applications to streamline operations.

The newly unveiled strategy highlights Chegg’s desire to offer an integrated platform that combines academic and functional support. This includes areas such as organizational skills, early career training, financial literacy, and community engagement. To differentiate itself from competitors that offer more generic educational tools, Chegg plans to leverage artificial intelligence tailored specifically for education, backed by over 100 million pieces of content and expert contributions, to deliver a unique and robust learning experience.

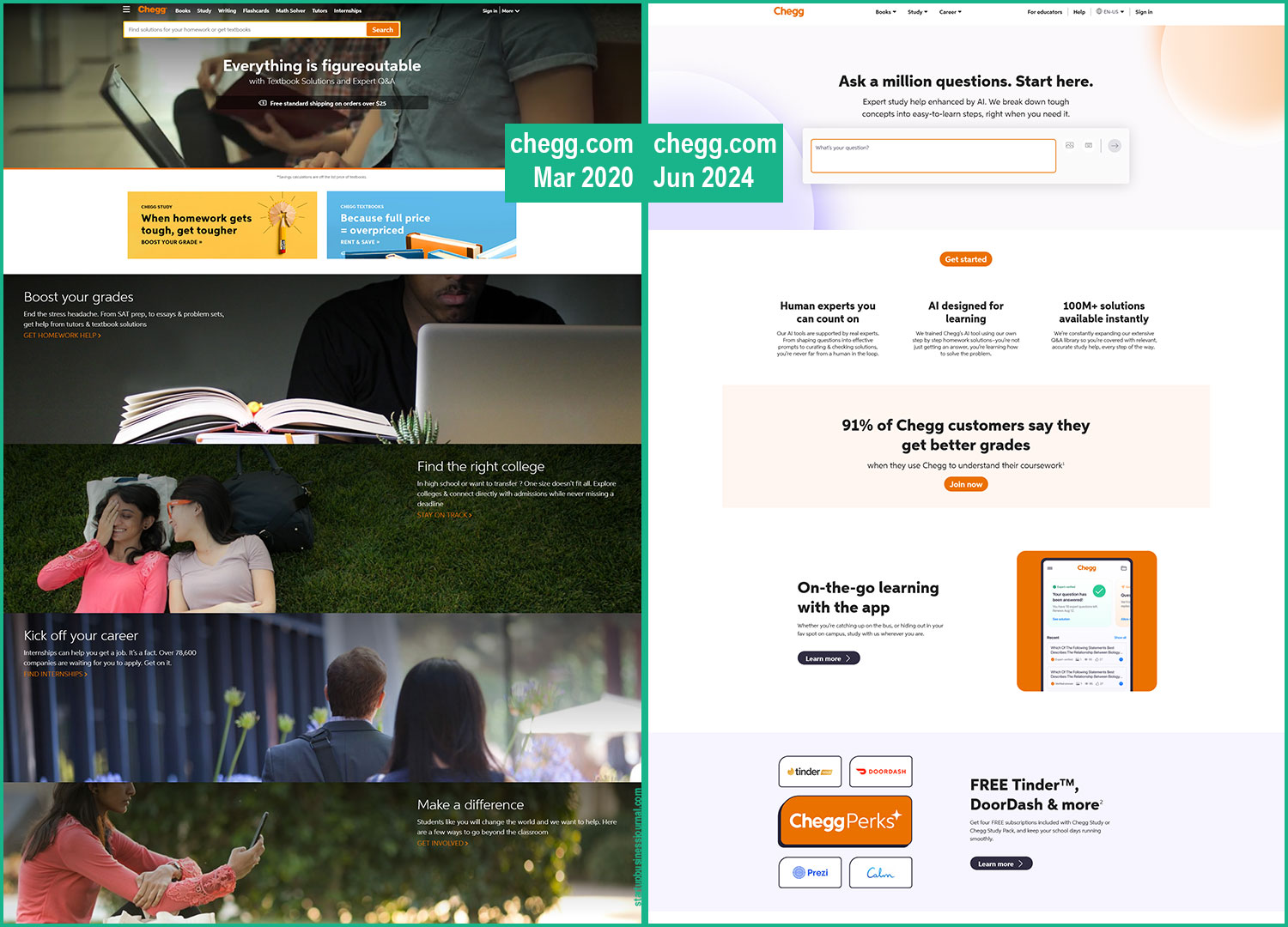

Chegg has faced challenges before and has made numerous adjustments to its business model throughout the years. Chegg started out in 2000 as a classifieds board at Iowa State. In 2005 they pivoted to primarily being a textbook seller and later adding a suite of educational support services. It is these services that propelled Chegg to soar during the pandemic, with shares trading as high as $105. It is these same services that are threatened by ChatGPT and other Generative AI tools. At the close of business today Chegg was trading at $2.85.

David Longo, Chegg’s Chief Financial Officer, emphasized the financial benefits of the restructuring. “We anticipate non-GAAP expense savings of $40 million to $50 million in 2025 due to the workforce reduction and office closures. Our aim is to achieve a 30%+ Adjusted EBITDA margin and generate at least $100 million in free cash flow by next year.”

The restructuring is expected to incur a charge of $10 million to $14 million, with about half of this charge recognized in the second quarter of 2024. The overall cost savings will result from employee departures, the closure of two international offices, and other cost-cutting measures.