American leadership in technology innovation and economic competitiveness is at risk if U.S. policymakers don’t take crucial steps to protect the country’s digital future. The country that gave the world the internet and the very concept of the disruptive startup could find its role in the global innovation economy slipping from reigning incumbent to a disrupted has-been.

My research, conducted with Ravi Shankar Chaturvedi, investigates our increasingly digital global society, in which physical interactions – in communications, social and political exchange, commerce, media and entertainment – are being displaced by electronically mediated ones. Our most recent report, “Digital Planet 2017: How Competitiveness and Trust in Digital Economies Vary Across the World,” confirms that the U.S. is on the brink of losing its long-held global advantage in digital innovation.

Our yearlong study examined factors that influence innovation, such as economic conditions, governmental backing, startup funding, research and development spending and entrepreneurial talent across 60 countries. We found that while the U.S. has a very advanced digital environment, the pace of American investment and innovation is slowing. Other countries – not just major powers like China, but also smaller nations like New Zealand, Singapore and the United Arab Emirates – are building significant public and private efforts that we expect to become foundations for future generations of innovation and successful startup businesses.

Based on our findings, I believe that rolling back net neutrality rules will jeopardize the digital startup ecosystem that has created value for customers, wealth for investors and globally recognized leadership for American technology companies and entrepreneurs. The digital economy in the U.S. is already on the verge of stalling; failing to protect an open internet would further erode the United States’ digital competitiveness, making a troubling situation even worse.

Comparing competitiveness

In the U.S., the reins of internet connectivity are tightly controlled. Just five companies – Comcast, Spectrum, Verizon, CenturyLink and AT&T – serve more than 80 percent of wired-internet customers. What those companies provide is both slower and more expensive than in many countries around the world. Ending net neutrality, as the Trump administration has proposed, would give internet providers even more power, letting them decide which companies’ innovations can reach the public, and at what costs and speeds.

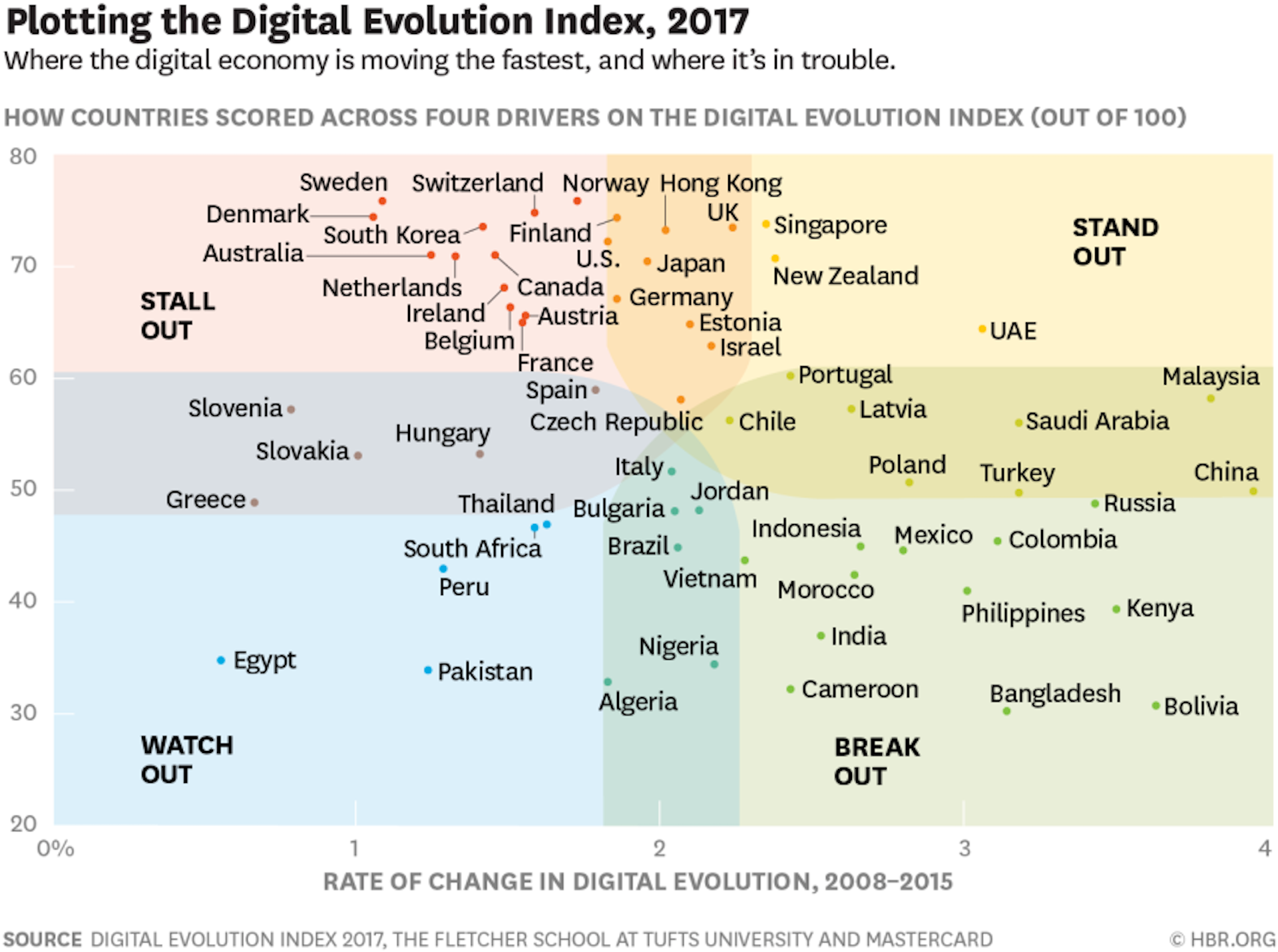

However, our research shows that the U.S. doesn’t need more limits on startups. Rather, it should work to revive the creative energy that has been America’s gift to the digital planet. For each of the 60 countries we examined, we combined 170 factors – including elements that measure technological infrastructure, government policies and economic activity – into a ranking we call the Digital Evolution Index.

To evaluate a country’s competitiveness, we looked not only at current conditions, but also at how fast those conditions are changing. For example, we noted not only how many people have broadband internet service, but also how quickly access is becoming available to more of a country’s population. And we observed not just how many consumers are prepared to buy and sell online, but whether this readiness to transact online is increasing each year and by how much.

The countries formed four major groups:

- “Stand Out” countries can be considered the digital elite; they are both highly digitally evolved and advancing quickly.

- “Stall Out” countries have reached a high level of digital evolution, but risk falling behind due to a slower pace of progress and would benefit from a heightened focus on innovation.

- “Break Out” countries score relatively low for overall digital evolution, but are evolving quickly enough to suggest they have the potential to become strong digital economies.

- “Watch Out” countries are neither well advanced nor improving rapidly. They have a lot of work to do, both in terms of infrastructure development and innovation.

The US is stalling out

The picture that emerges for the U.S. is not a pretty one. Despite being the 10th-most digitally advanced country today, America’s progress is slowing. It is close to joining the major EU countries and the Nordic nations in a club of nations that are, digitally speaking, stalling out.

The “Stand Out” countries are setting new global standards of high states of evolution and high rates of change, and exploring various innovations such as self-driving cars or robot policemen. New Zealand, for example, is investing in a superior telecommunications system and adopting forward-looking policies that create incentives for entrepreneurs. Singapore plans to invest more than US$13 billion in high-tech industries by 2020. The United Arab Emirates has created free-trade zones and is transforming the city of Dubai into a “smart city,” linking sensors and government offices with residents and visitors to create an interconnected web of transportation, utilities and government services.

The “Break Out” countries, many in Asia, are typically not as advanced as others at present, but are catching up quickly, and are on pace to surpass some of today’s “Stand Out” nations in the near future. For example, China – the world’s largest retail and e-commerce market, with the world’s largest number of people using the internet – has the fastest-changing digital economy. Another “Break Out” country is India, which is already the world’s second-largest smartphone market. Though only one-fifth of its 1.3 billion people have online access today, by 2030, some estimates suggest, 1 billion Indians will be online.

By contrast, the U.S. is on the edge between “Stand Out” and “Stall Out.” One reason is that the American startup economy is slowing down: Private startups are attracting huge investments, but those efforts aren’t paying off when the startups are either acquired by bigger companies or offer themselves on the public stock markets.

Investors, business leaders and policymakers need to take a more realistic look at the best way to profit from innovation, balancing efforts toward both huge results and modest ones. They may need to recall the lesson from the founding of the internet itself: If government invests in key aspects of digital infrastructure, either directly or by creating subsidies and tax incentives, that lays the groundwork for massive private investment and innovation that can transform the economy.

In addition, investments in Asian digital startups have exceeded those in the U.S. for the first time. According to CB Insights and PwC, US$19.3 billion in venture capital from sources around the world was invested in Asian tech startups in the second quarter of 2017, while the U.S. had $18.4 billion in new investment over the same period.

This is consistent with our findings that Asian high-momentum countries are the ones in the “Break Out” zone; these countries are the ones most exciting for investors. Over time, the U.S.-Asia gap could widen; both money and talent could migrate to digital hot spots elsewhere, such as China and India, or smaller destinations, such as Singapore and New Zealand.

For the country that gave the world the foundations of the digital economy and a president who seems perpetually plugged in, falling behind would, indeed, be a disgrace.